Believe it or not, millennials and loans go hand in hand. Somehow our generation is destined to go into debt if we want to do anything all.

Somehow, we all grew accustomed to loaning more and more to do basic things the previous generation managed to do without debt. Times have changed, priorities as well. The whole world is changing, sometimes for the better, while other times not as much. You have to get your finances back on track, go talk to a consultant from AmericanDebtEnders today.

Don’t get me wrong there are many different kinds of loans we can consider and somehow those small loans, such as littleloans, are growing more and more popular. Why? Well, the sheer fact that they are quick and with low interests that you can easily repay is one thing. Other is that they are accessible to almost everyone.

You can use these for any type of unforeseen emergency or pay off a sudden huge bill you haven’t hoped for.

Source: pixabay.com

Sometime before these small and fast loans weren’t considered as good but the times have changed greatly and they changed for good. There are no outstanding interest rates, the short time to repay seems to suit everyone who uses these loans and the lenders have been thoroughly checked out and regulated which boasts confidence additionally.

But why is it exactly do we need these loans, and how is this young, smart, and resourceful generation succumb to this much debt and why do they need loans at all? This needs a bit of clarification and the next part of this article will address it.

Where does the problem begin?

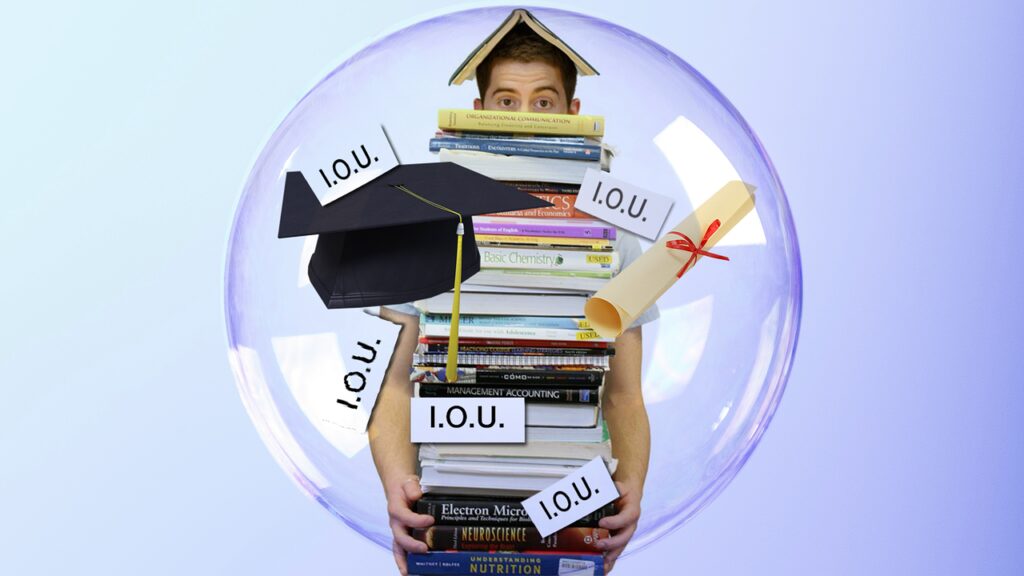

Well, it starts with your education. More and more millennials are choosing higher education and they are prioritizing it over marriage or a first job. Why? Well, the sheer fact is that by gaining higher education you have a lot more options in life and a higher earning potential. Where is the problem? The problem is that the prices of education have soared in the past decade and to get a college degree now means a huge debt and sometimes choosing between rent or food.

Source: unsplash.com

This is scary to think about. Many students today are struggling to pay for educations, huge rents and to put food in their mouth. According to a survey we found somewhere around 45% of students can’t afford meals. This is outrageous and this is where problems start. Take a loan to pay for school, rent and food and when you graduate you carry weight around your neck called a student loan that is something over $30.000.

When you start your working life with a huge debt behind you it is somewhat difficult to get up to speed with everything. Another thing to worry about is where to live and what to eat after you find your job. You still have to pay the loan out, but you have another rent, and food and God know what can rack up additionally. If you work a bit further from where you live you will need a car, or pay for transportation – another cost. You want or need to join a gym because you can’t maintain your health and do the job you do at the same time – another cost. It keeps racking up and it will eventually lead you to need a loan to help pay a loan. As a college graduate with outstanding student loans, your best option might be a refinancing option to get better interest rates that will dramatically reduce your payments and help you save money. If you need help refinancing your student loans, click here.

One more research states that millennials have racked up a huge debt, probably the biggest one since 2007. According to that research, millennials owe around $1 trillion and this is just insane. In this study student loans play a huge role and they surpass all mortgages, auto loans, credit card debts, or any other types of loans by miles. Student loans and mortgage loans take up 38% and 35% of your budget respectfully.

What is the culprit here? Well as I mentioned at the beginning everything has changed and some things changed for the worse. If you are a millennial then you know one thing for sure your parents lived better than then you do now.

Source: pixabay.com

How come? Well, the median wages have been growing only 0.3% per year for the last 10 or 12 years. The generation of your parents remembers a wage growth of 3% yearly. That is the first thing. The second thing is that costs climbed up while the wages try to follow but fail miserably. Housing and education cost has been growing through the roof in that period and this is why millennials owe fewer homes than their parents, while their education costs nearly tripled than what their parent paid.

These are all the things that should answer the question from the article title – Why are loans so popular with younger generations? How wouldn’t they be? We are fighting a gorilla with a banana. Take a loan to cover a loan and do this as much as possible. It is practically an enchanted circle from which we can’t get out. To be perfectly honest debt isn’t that bad but only if you can pay it back. How able are we? Well, around 11% of all student debts are delinquent meaning it hasn’t been paid in a period over 90 days. To put that into a perspective ten years ago the delinquency rate was around 7% and if you still do not understand that a lower delinquency number is better because it means that more people are keeping up with their loan payments.

The positive side is that we already learned to live that way. Thankfully millennials are a resourceful generation and any extra income that can be brought in will be made to lower the personal debt we racked up in the process of getting where we are. There is hope though but it will have to come from the government. It has to be in a form of policies that go toward debt relief which would help greatly, affordable housing and followed by more acquirable tax code for renters.

Only these few policies would help out tremendously and in a few years, I bet it would nearly half our debts and give us the fighting chance we deserve. Changes will come we just have to wait them out and in the meantime find out by ourselves how to survive the financial jungle we have been thrown in so abruptly. The problem is that even our parents are struggling in this new age and there is small to no help to be expected from them.